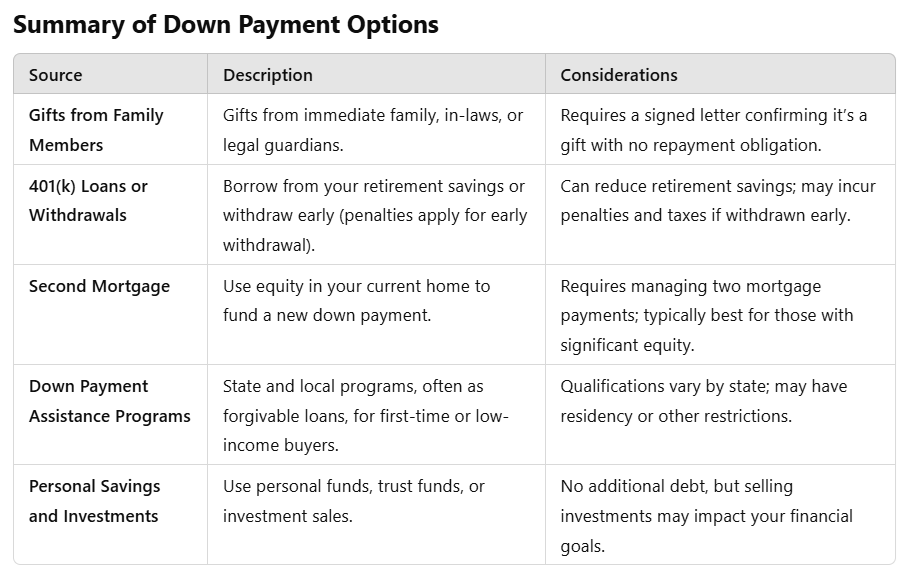

Buying a home is a big milestone, and for many, saving for a down payment can feel like a major hurdle. Fortunately, there are several ways to make that down payment happen. Whether through savings, family gifts, 401(k) funds, or even second mortgages, understanding your options is key to making the best financial choice. Let’s break down each of these options so you can explore what works best for you.

Buying a home is a big milestone, and for many, saving for a down payment can feel like a major hurdle. Fortunately, there are several ways to make that down payment happen. Whether through savings, family gifts, 401(k) funds, or even second mortgages, understanding your options is key to making the best financial choice. Let’s break down each of these options so you can explore what works best for you.

1. Family Gifts for a Down Payment

For many homebuyers, especially first-time buyers, gifted money from family members is a valuable resource. However, lenders have specific guidelines about gift funds, so it’s essential to understand how these gifts work in the context of a mortgage.

- Who Can Gift Money?

- Immediate family members: Parents, siblings, and grandparents.

- Relatives by marriage: In-laws can sometimes help out as well.

- Legal guardians or close friends: With proper documentation, these individuals may also gift funds for your down payment.

- Documentation Requirements:

Lenders typically require a signed letter from the person giving the gift, confirming that the money is a gift and does not need to be repaid. Some loan programs also have restrictions on who can provide the gift, so be sure to check with your lender.

2. Using Your 401(k) for a Down Payment

Using retirement funds, like your 401(k), is another option to access funds for a down payment, but it’s essential to weigh the pros and cons.

- 401(k) Loan: You can borrow up to 50% of your vested balance (up to $50,000). The advantage is that you’re borrowing from yourself and paying yourself back with interest.

- 401(k) Early Withdrawal: If you withdraw money before 59½, you’ll face a 10% penalty and owe income taxes on the withdrawn amount. This method provides fast access to cash but can significantly impact your retirement savings.

Tip: Make sure to discuss with a financial advisor before taking from your 401(k), as it can affect your retirement timeline.

3. Taking a Second Mortgage

If you already own a home with significant equity, a second mortgage can provide funds for a down payment on a new property.

- Home Equity Loan or Line of Credit: You can use equity from your current home as a down payment on your new property. This option requires careful planning since you’ll manage payments on two mortgages.

Note: This option is less common for first-time buyers but can be effective if you’re purchasing an investment property or moving up to a larger home.

4. Down Payment Assistance Programs

First-time homebuyers and those with limited savings may qualify for down payment assistance programs. Often available through state and local governments, these programs can help cover part or all of your down payment.

- Forgivable Second Mortgage: This is a form of assistance that resembles a second mortgage, but it may be forgiven after a set number of years if you meet certain conditions, such as living in the home for a specified period.

- Targeted Demographics:

- First-time homebuyers

- Low- to moderate-income families

- Buyers in designated revitalization areas

Each state or locality has different requirements, so check with your local housing authority to learn more about available options.

5. Other Sources for a Down Payment

If you have other assets, there are additional ways to fund your down payment. Here are some alternative sources:

- Personal Savings: A common choice that involves no loans or additional paperwork.

- Trust Funds: If you have access to a trust fund, this can be a great way to cover your down payment without repayment requirements.

- Sale of Investments: If you hold investments like stocks or bonds, selling them can provide funds. Remember to account for any capital gains taxes and consider the impact on your long-term financial goals.

6. Loan Program Differences and Allowable Down Payment Sources

Different loan programs have specific rules about down payment sources, so it’s essential to know which options align with the program you’re using.

- Conventional Loans:

- Typically allow personal savings, gifts from immediate family members, and proceeds from investments.

- Some conventional loans allow second mortgages but with restrictions.

- FHA Loans:

- More flexible, allowing gifts from family, friends, employers, and even charitable organizations.

- Second mortgages may also be acceptable, particularly with down payment assistance programs.

- VA Loans:

- Often require no down payment, making them a great option for veterans. If a down payment is required, gifts from family members are allowed.

- USDA Loans:

- Typically require no down payment but allow personal savings and gift funds as acceptable sources if one is needed.

Choosing the Best Down Payment Strategy

Selecting the best method for funding your down payment depends on your financial goals, risk tolerance, and current assets. If you’re uncertain about the best approach, consulting with a mortgage professional can provide insights tailored to your unique situation. We are here to help you explore all available options and make informed decisions.