by Mark Maldonado | Sep 5, 2025 | Mortgage Tips

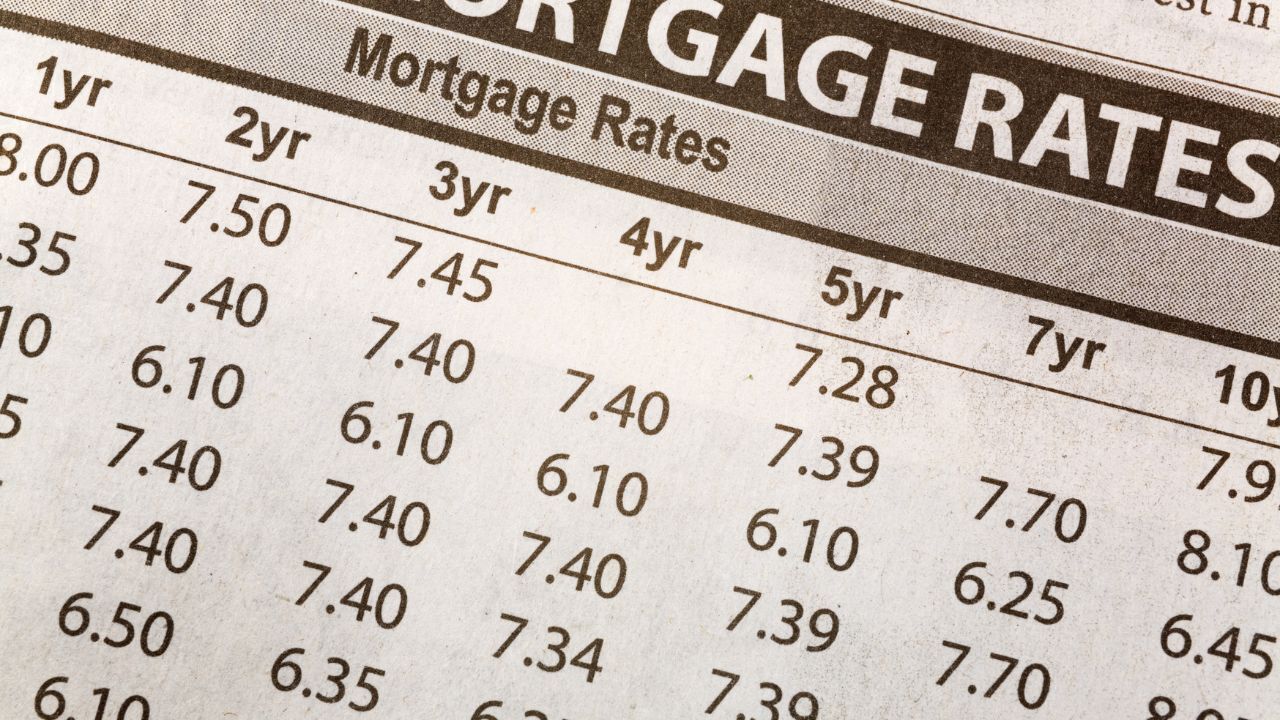

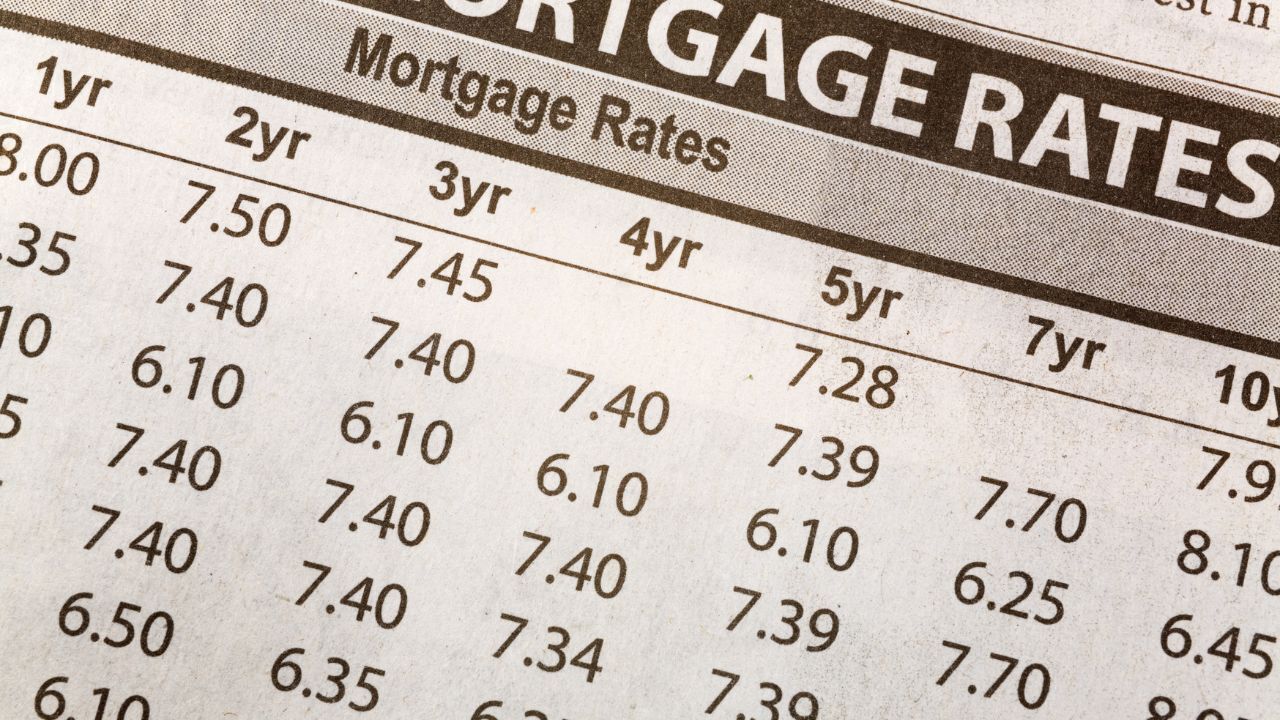

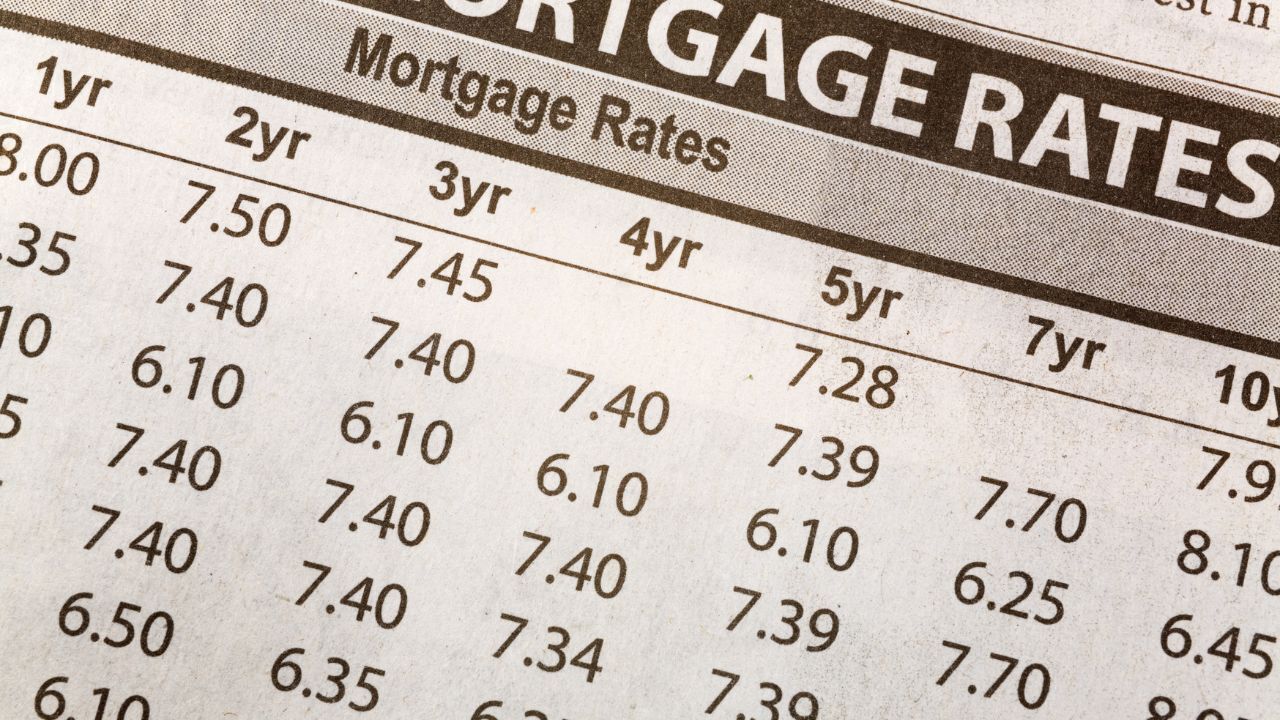

Understanding the Impact of Rising Rates Mortgage rates play a major role in how much house you can afford. Even a small increase can raise monthly payments and affect how much you qualify for. For example, the same loan amount at a higher rate could cost hundreds of...

by Mark Maldonado | Sep 4, 2025 | Mortgage Tips

The rise of cryptocurrency and digital assets has transformed the way many people invest and build wealth. As more buyers hold Bitcoin, Ethereum, and other digital currencies, the question of how these assets impact mortgage approval has become more common. While...

by Mark Maldonado | Sep 3, 2025 | Mortgage Tips

Starting your life together as a married couple is an exciting season filled with new milestones. One of the biggest decisions many newlyweds face is whether to buy a home together. While combining households and finances can feel overwhelming, taking time to...

by Mark Maldonado | Sep 2, 2025 | Financial Reports

With the release of the PCE Index, inflation has shown to still be creeping upwards but there is significant speculation that the Federal Reserve will continue with their interest rate cut in the future. Meanwhile, the Consumer Sentiment report has been growing...

by Mark Maldonado | Sep 1, 2025 | Holidays

Today we celebrate the hard work, dedication, and dreams of so many families. Labor Day is more than just a day off, it is a reminder of why we work hard: to create a life we love and a place we are proud to call home. Whether you are grilling in the backyard,...