by Mark Maldonado | Jan 22, 2025 | Home Mortgage Tips

Dreaming of owning a home? Preparing your finances for a mortgage is key to making that dream a reality. Here’s how to get started: 1. Create a Budget Understanding how much you can afford is the first step. Review your monthly expenses and set a target mortgage...

by Mark Maldonado | Jan 21, 2025 | Financial Reports

Recent economic data brought significant relief, with both the CPI and PPI indicating that inflation was running cooler than expected. In the context of the current administration, this was welcome news, helping to ease concerns about potential monetary policy...

by Mark Maldonado | Jan 17, 2025 | Home Buyer Tips

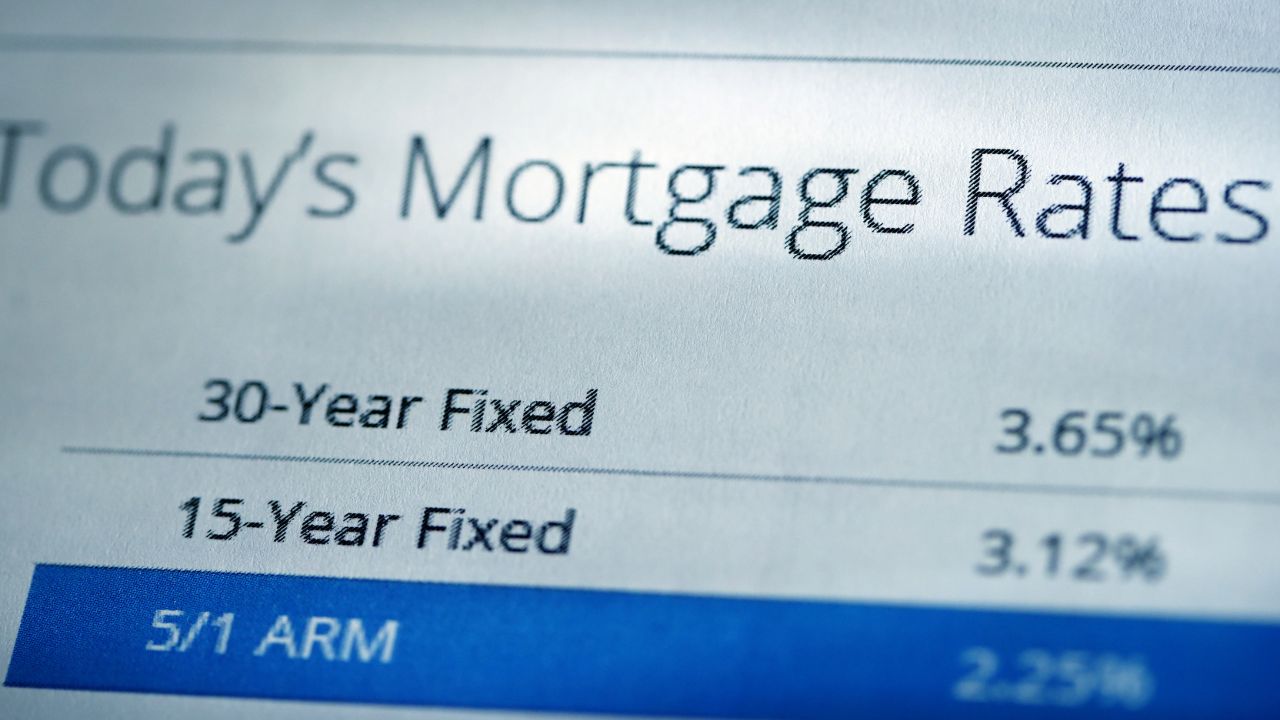

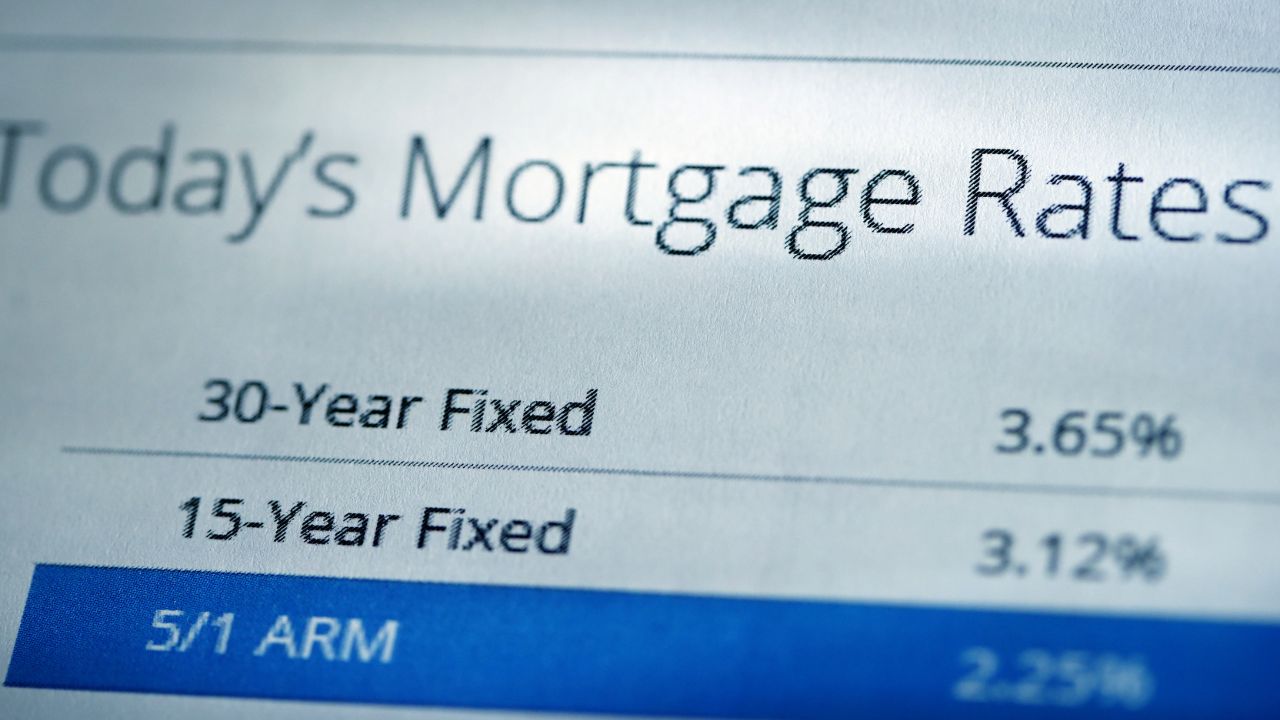

Mortgage rates play a significant role in determining how much home you can afford. These rates influence the cost of borrowing money for your mortgage, which directly impacts your monthly payment and, ultimately, your home buying power. The Impact of Mortgage Rates...

by Mark Maldonado | Jan 16, 2025 | Home Mortgage Tips

For many potential homeowners, the dream of buying a house can feel out of reach, especially when saving for a large down payment or dealing with credit challenges. That’s where FHA loans come in. Backed by the Federal Housing Administration, these loans have...

by Mark Maldonado | Jan 15, 2025 | Home Mortgage Tips

When you begin the exciting journey toward homeownership, understanding the financial aspects is vital. A key document in this process is the Loan Estimate. Provided by lenders when you apply for a mortgage, the Loan Estimate is your guide to deciphering the terms of...