by Mark Maldonado | Jul 8, 2024 | Financial Reports

With the FOMC Minutes coming precisely within expectations, there is once again a lot of optimism that the Federal Reserve may cut rates this year. Much of the Q2 data reports show favorable amounts of reduction in inflation as well as a more stable economic outlook...

by Mark Maldonado | Jul 5, 2024 | Mortgage

Mortgage life insurance is a type of policy designed to pay off your mortgage in the event of your death. As with any financial product, it has its pros and cons. Understanding these can help you determine whether it makes sense for your situation. What is Mortgage...

by Mark Maldonado | Jul 4, 2024 | Holidays

While fireworks, barbecues, and parades are fundamental to our 4th of July celebrations, the spirit of Independence Day runs much deeper. It’s a time to honor our history, recognize our freedoms, and celebrate the unity that defines us as a nation. A History...

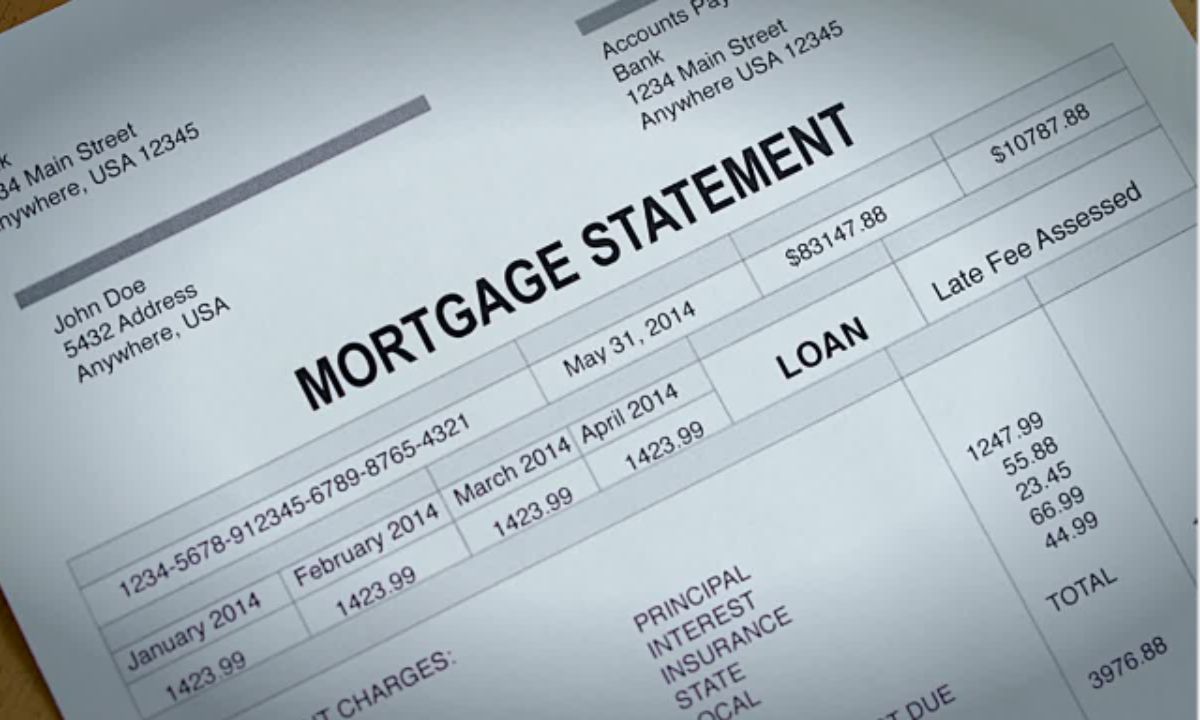

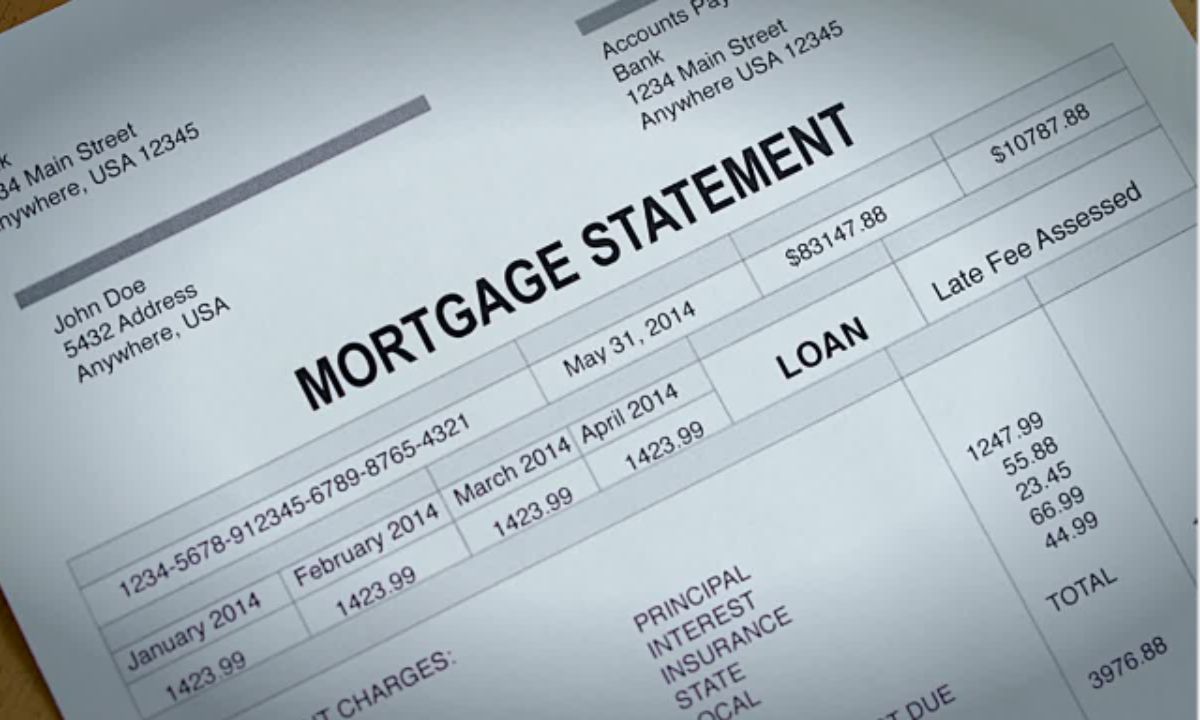

by Mark Maldonado | Jul 3, 2024 | Mortgage

Your mortgage statement is an important document that provides detailed information about your home loan. Understanding it can help you manage your mortgage more effectively, identify potential issues early, and ensure you’re on track with your payments. Here is...

by Mark Maldonado | Jul 2, 2024 | Mortgage

When it comes to buying a home, you will find many mortgage options available. One of the lesser-known but potentially advantageous choices is the Graduated Payment Mortgage (GPM). Let’s discuss what GPMs are, how they work, and how they differ from other...