by Mark Maldonado | Nov 5, 2025 | Mortgage Tips

One of the first questions homebuyers ask is how much they can afford to borrow. While the number may seem mysterious, lenders use a clear set of financial factors to decide how much you qualify for. Understanding these factors can help you plan ahead, make smart...

by Mark Maldonado | Nov 4, 2025 | Home Buyer Tips

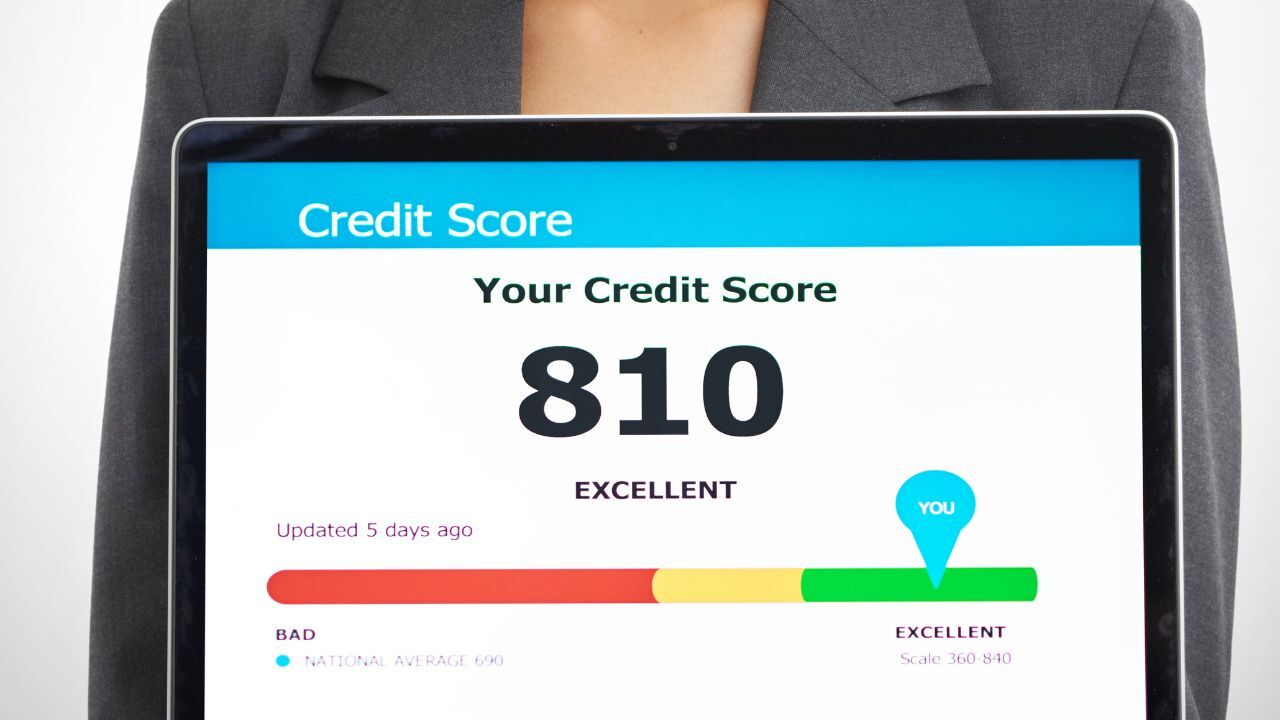

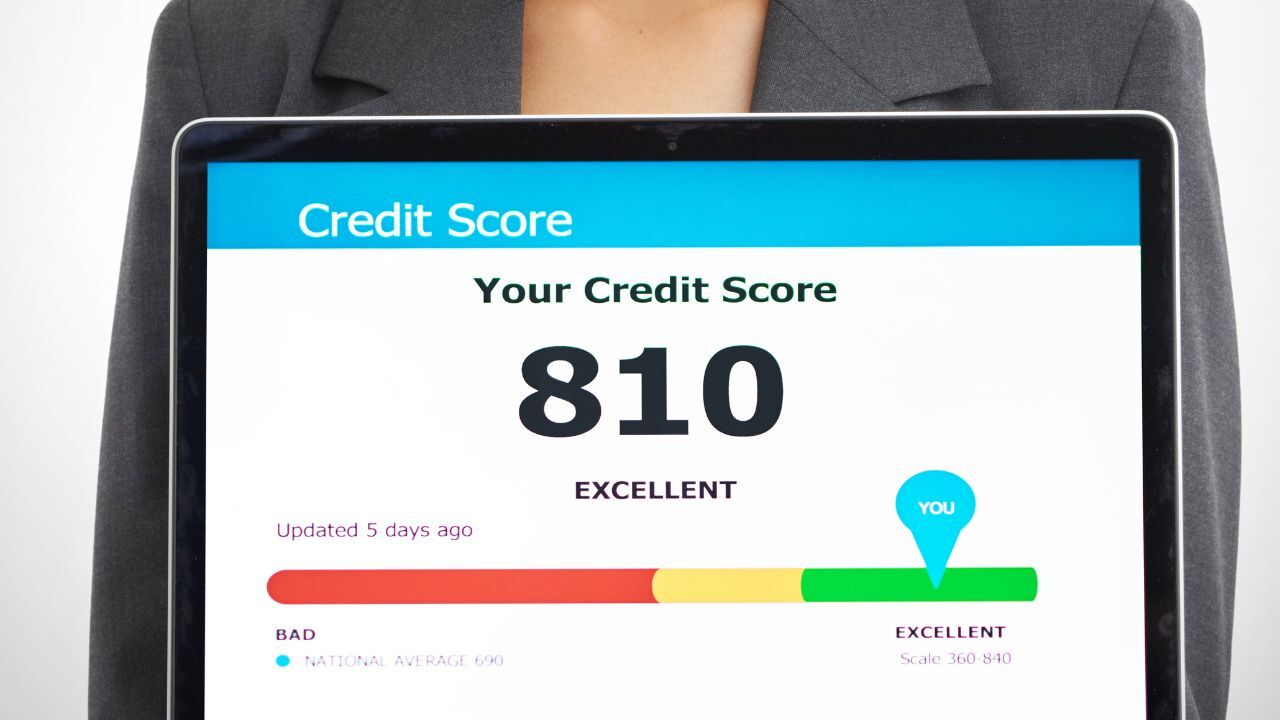

Buying a home is one of the most exciting goals you can set, but your credit score plays a major role in how easy or challenging the process will be. The good news is that with time and planning, you can strengthen your credit and set yourself up for a smoother...

by Mark Maldonado | Nov 3, 2025 | Financial Reports

With the ongoing government shutdown, other major releases have hit a snag, as there is still very limited information for when the shutdown may end. The largest and most impactful releases continuing to move forward are those from third-party sources still publishing...

by Mark Maldonado | Oct 31, 2025 | Mortgage Tips

Homeowners looking to save on interest or shorten their loan term often explore two popular strategies: biweekly payments and lump sum payments. Both can reduce the total interest paid and help you build equity faster, but they work in different ways. Understanding...

by Mark Maldonado | Oct 30, 2025 | Real Estate Tips

A Home Equity Line of Credit, or HELOC, can be a powerful financial tool. It allows homeowners to borrow against the equity in their property, often at a lower interest rate than other types of credit. Some borrowers use HELOCs to fund investments such as real estate,...