Blog

Latest Articles

Mortgage rates, information on mortgages,

real estate, and more!

Why Credit Monitoring Matters During the Mortgage Process

Buying a home is one of the most significant financial decisions you will make. While it is exciting to pick out your dream home, the mortgage process can be complex and stressful. One critical factor that can make or break your journey is your credit. Credit monitoring gives you the insight and control you need to stay on track.

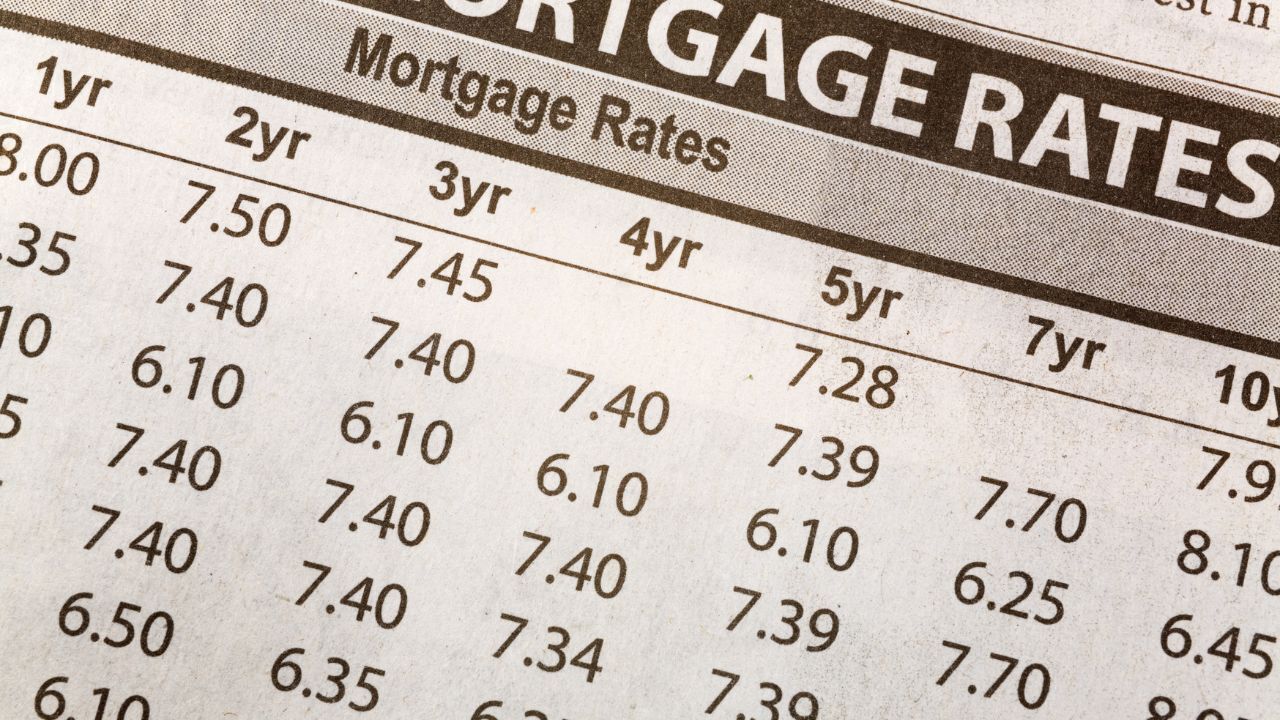

What’s Ahead For Mortgage Rates This Week – September 8th, 2025

The release of major inflation data has once again arrived with the Consumer Price Index and the Producer Price Index, offering insight into the current state of the economy. Based on recent statements from the Federal Reserve, there is considerable speculation that rate cuts may occur regardless of the trajectory of inflation.

Mortgages in a Rising Rate Environment: Strategies to Save

When interest rates begin to climb, many buyers feel uncertain about whether it is the right time to purchase a home. Higher rates can impact affordability and monthly payments, but that does not mean homeownership is out of reach. With the right strategies and preparation, you can still secure a mortgage that fits your budget and long-term goals.

How Cryptocurrency and Digital Assets Are Affecting Mortgage Approval

The rise of cryptocurrency and digital assets has transformed the way many people invest and build wealth. As more buyers hold Bitcoin, Ethereum, and other digital currencies, the question of how these assets impact mortgage approval has become more common. While lenders are beginning to recognize cryptocurrency, it is still a developing area that requires careful planning.

Mortgages for Newlyweds, Combining Finances and Buying Your First Home

Starting your life together as a married couple is an exciting season filled with new milestones. One of the biggest decisions many newlyweds face is whether to buy a home together. While combining households and finances can feel overwhelming, taking time to understand how mortgages work and planning together can set you up for long-term success.

What’s Ahead For Mortgage Rates This Week – September 2nd 2025

With the release of the PCE Index, inflation has shown to still be creeping upwards but there is significant speculation that the Federal Reserve will continue with their interest rate cut in the future. Meanwhile, the Consumer Sentiment report has been growing pessimistic amidst the job market, which has been shown to be in a pattern of cooling down.

This is offset by the strong growth by the GDP estimates for the second quarter, as it was initially predicted the tariff changes would have a significant impact on the GDP estimates, but the impact has been less prominent than expected.