Blog

Latest Articles

Mortgage rates, information on mortgages,

real estate, and more!

What’s Ahead For Mortgage Rates This Week – November 10th, 2025

With the government shutdown heading into a possible resolution, there were still delays on important data such as employment report releases. This has been somewhat relieved with the release of other reports that have been delayed in the past within the current government shutdown.

When and How to Secure a Favorable Mortgage Rate Lock

Interest rates can fluctuate from one week to the next, and that can have a major impact on your monthly payment and overall loan cost. A mortgage rate lock gives you the ability to secure your interest rate for a set period of time, protecting you from unexpected increases while your loan is being finalized. Understanding how rate locks work can help you choose the right time and terms for your situation.

What to Expect at Your First Mortgage Appointment

Meeting with a lender for the first time is a big step in your homebuying journey. Whether you are buying your first home or upgrading to your next one, your mortgage appointment sets the stage for what comes next. Knowing what to expect helps you feel confident, prepared, and ready to make the most of that important conversation.

What Mortgage Lenders Really Look At Before Approving Your Loan

One of the first questions homebuyers ask is how much they can afford to borrow. While the number may seem mysterious, lenders use a clear set of financial factors to decide how much you qualify for.

Understanding these factors can help you plan ahead, make smart choices, and feel confident as you start your homebuying journey.

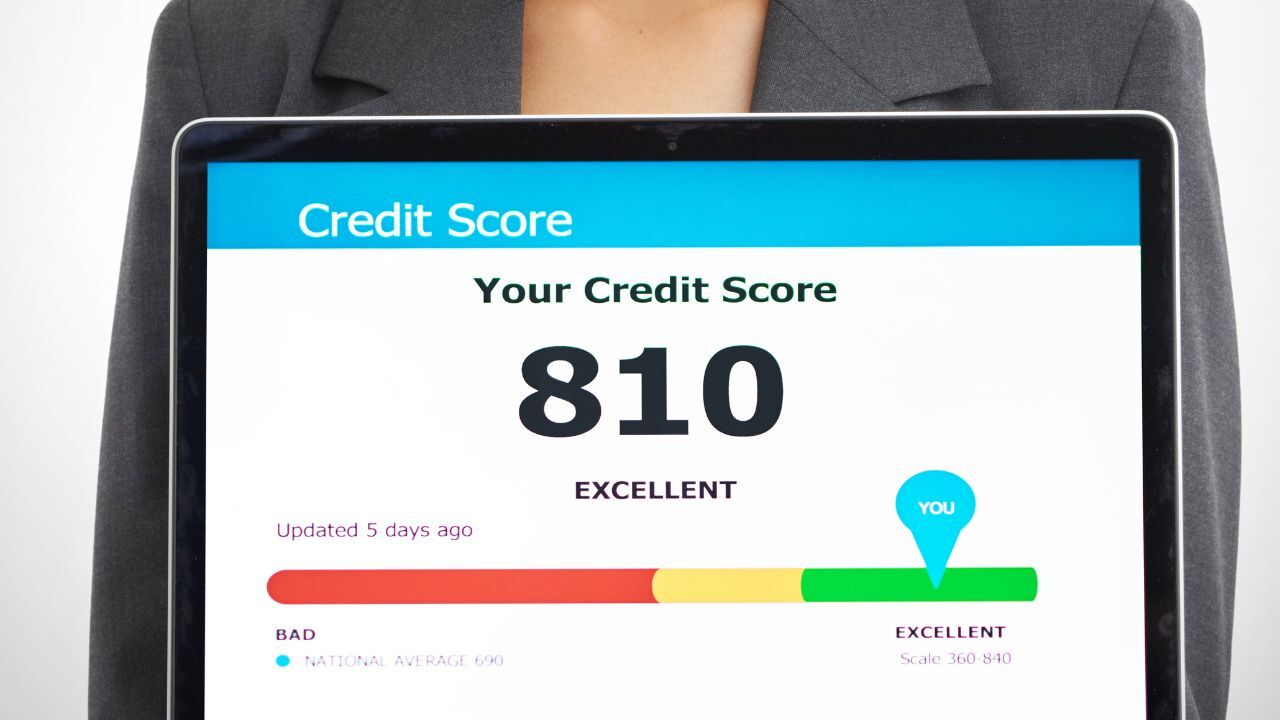

Steps to Take Now to Build Your Credit for a Home Purchase Next Year

Buying a home is one of the most exciting goals you can set, but your credit score plays a major role in how easy or challenging the process will be. The good news is that with time and planning, you can strengthen your credit and set yourself up for a smoother approval when you are ready to buy next year.

What’s Ahead For Mortgage Rates This Week – November 3rd, 2025

With the ongoing government shutdown, other major releases have hit a snag, as there is still very limited information for when the shutdown may end. The largest and most impactful releases continuing to move forward are those from third-party sources still publishing data — such as the Consumer Sentiment report — which shows that consumers remain concerned about inflation but have recently grown more optimistic about the labor market.