by Mark Maldonado | May 31, 2024 | Mortgage Application

Understanding the difference between prime and subprime mortgages is essential for anyone entering the world of home financing. Prime mortgages are tailored for individuals with exemplary credit scores and stable financial profiles, offering them lower interest rates...

by Mark Maldonado | May 23, 2024 | Mortgage Application

The options for securing a mortgage have expanded beyond the brick-and-mortar banks to include online lenders. With this diversity comes a crucial decision for homebuyers: should you opt for the convenience of online lenders or stick with the familiarity of...

by Mark Maldonado | May 9, 2024 | Mortgage Application

Buying a home is one of the most significant financial decisions most of us will ever make. It’s a journey filled with excitement, anticipation, and sometimes, a touch of anxiety. Among the many steps involved in this process, understanding mortgage underwriting...

by Mark Maldonado | May 1, 2024 | Mortgage Application

Are you dreaming of owning your own home but facing obstacles in securing a mortgage? You’re not alone. Many aspiring homeowners encounter challenges due to factors like credit history, income, or debt-to-income ratio. There is a potential solution that could...

by Mark Maldonado | Feb 15, 2024 | Mortgage Application

If you are thinking about buying a new home shortly, you may already be searching online to get a feel for the different types of homes available in the local area. You may have reviewed your budget, and you may have a fair idea about a sales price that is comfortable...

by Mark Maldonado | Dec 21, 2023 | Mortgage Application

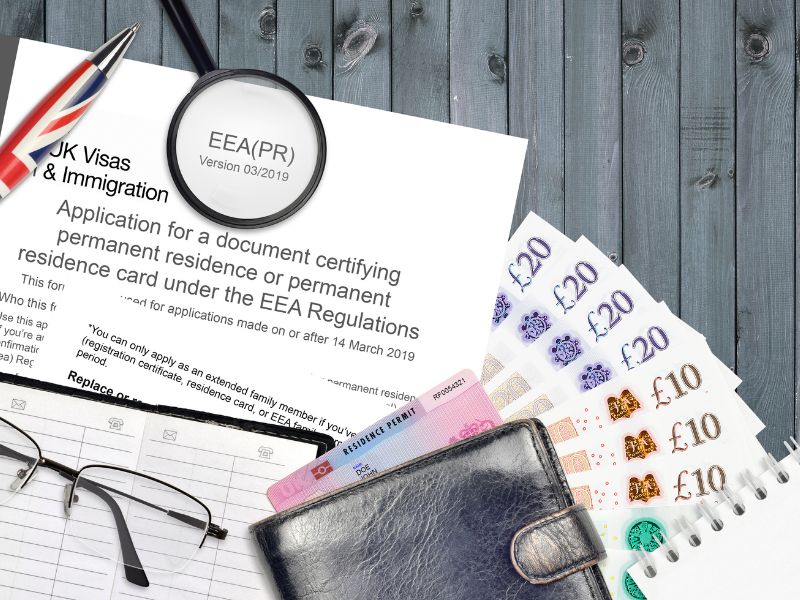

Becoming a homeowner in a foreign land is an exciting yet intricate journey. For non-U.S. citizens, securing a mortgage in the United States involves understanding and meeting specific requirements. We will explore the essential prerequisites and considerations for...