by Mark Maldonado | Mar 28, 2025 | Mortgage

If you’ve been managing your finances responsibly but don’t have a traditional credit score, you may be wondering whether homeownership is still within reach. The good news? It is! While most mortgage lenders rely on credit scores to assess your...

by Mark Maldonado | Mar 26, 2025 | Mortgage

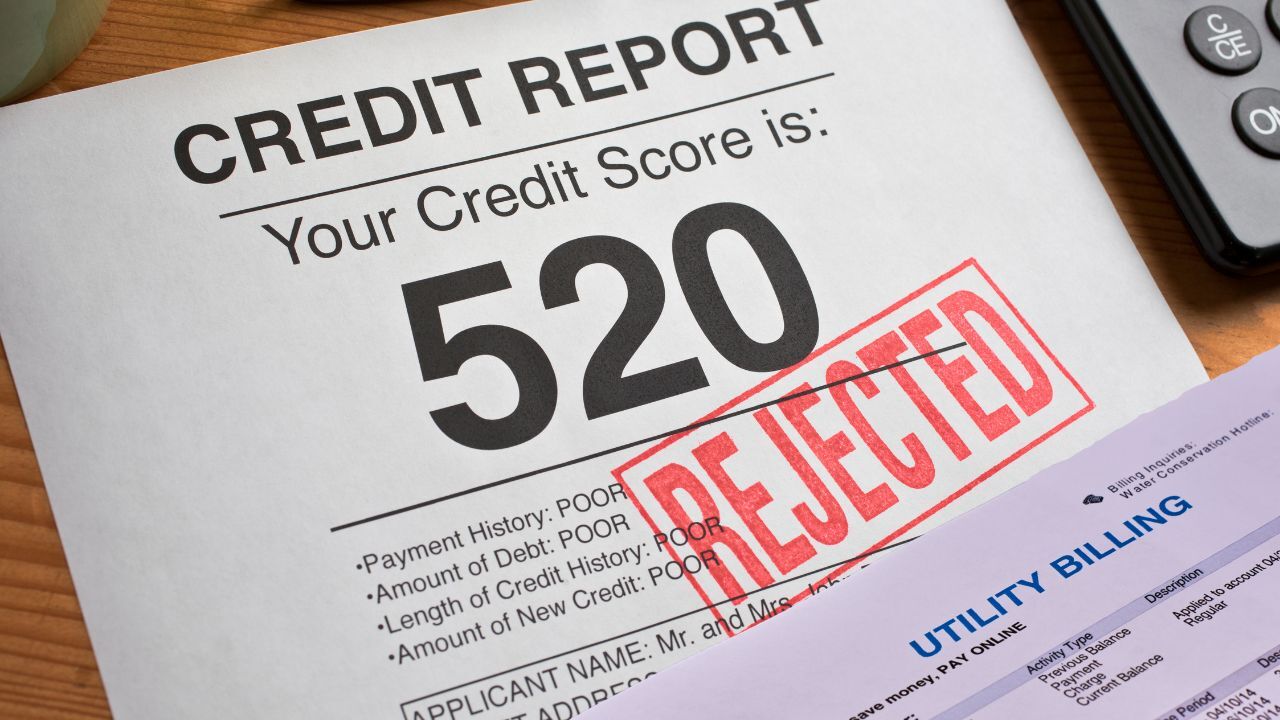

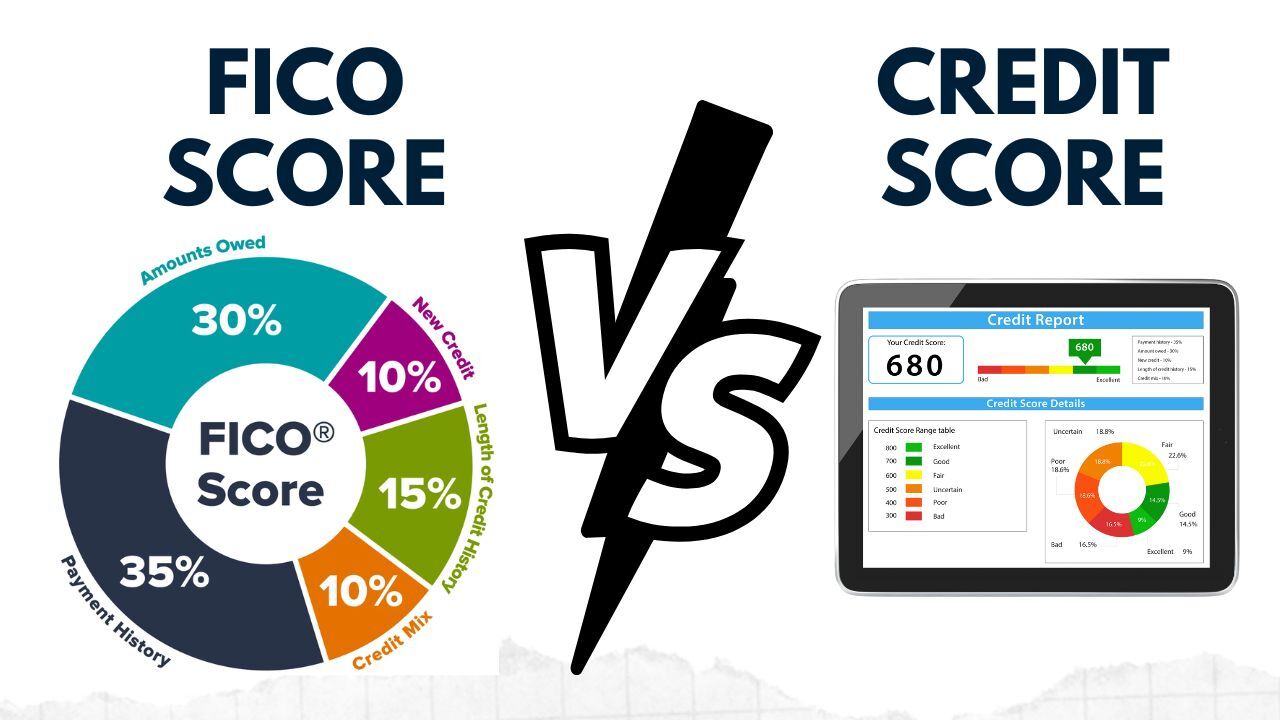

When applying for a mortgage, your creditworthiness plays a significant role in determining your loan approval and interest rates. Two commonly referenced terms are FICO score and credit score, which are often used interchangeably but have distinct differences. 1....

by Mark Maldonado | Mar 25, 2025 | Mortgage

Securing a mortgage as a self-employed professional can be more challenging than for traditional W-2 employees, but with the right preparation and documentation, it is entirely achievable. Here’s a guide to help you navigate the process: Document Your...

by Mark Maldonado | Mar 20, 2025 | Mortgage

For homeowners facing temporary financial hardship, mortgage payment deferral programs can provide much-needed relief. These programs allow borrowers to pause or reduce their monthly mortgage payments for a specific period, helping them avoid foreclosure while...

by Mark Maldonado | Jan 31, 2025 | Mortgage

Higher education can be one of the most significant financial investments you’ll make, second only to purchasing a home. While federal loans are a common method for covering college costs, using your home’s equity is another option to consider. Before...

by Mark Maldonado | Jan 10, 2025 | Mortgage

When it comes to buying a home, selecting the right mortgage is one of the most important financial decisions you’ll make. The type of loan you choose will impact your monthly payments, interest rates, and overall financial stability. To make the best choice,...